How to reflect in the IRPF the returns obtained with Inversa

As in previous years, we have prepared the following article to try to clarify in a practical way how *we understand that the returns obtained in Inversa should be reflected in the 2024 income tax return (IRPF) in order to help our investors.

At INVERSA Invoice Market, as a platform, we do not apply any withholding at source, so you will not see this information reflected in your tax report.

The returns obtained are taxed as capital gains in the 2024 IRPF based on the difference between the redeemed amount and the net invested amount (after deducting amounts received in advance). Therefore, the gain is not realized until the invoice is collected by the investor. From our point of view, invoice investing should be treated as the purchase of securities, not as loans.

For this interpretation, we rely on the fact that in the assignment of credits, where the debtor is informed of their obligation to pay the assignee, the payment is made by a third party (the debtor) and not by the assignor, making it a capital gain.

Instructions for the 2024 tax year to declare capital gains from investments made in Inversa through the AEAT website - RENTA WEB platform:

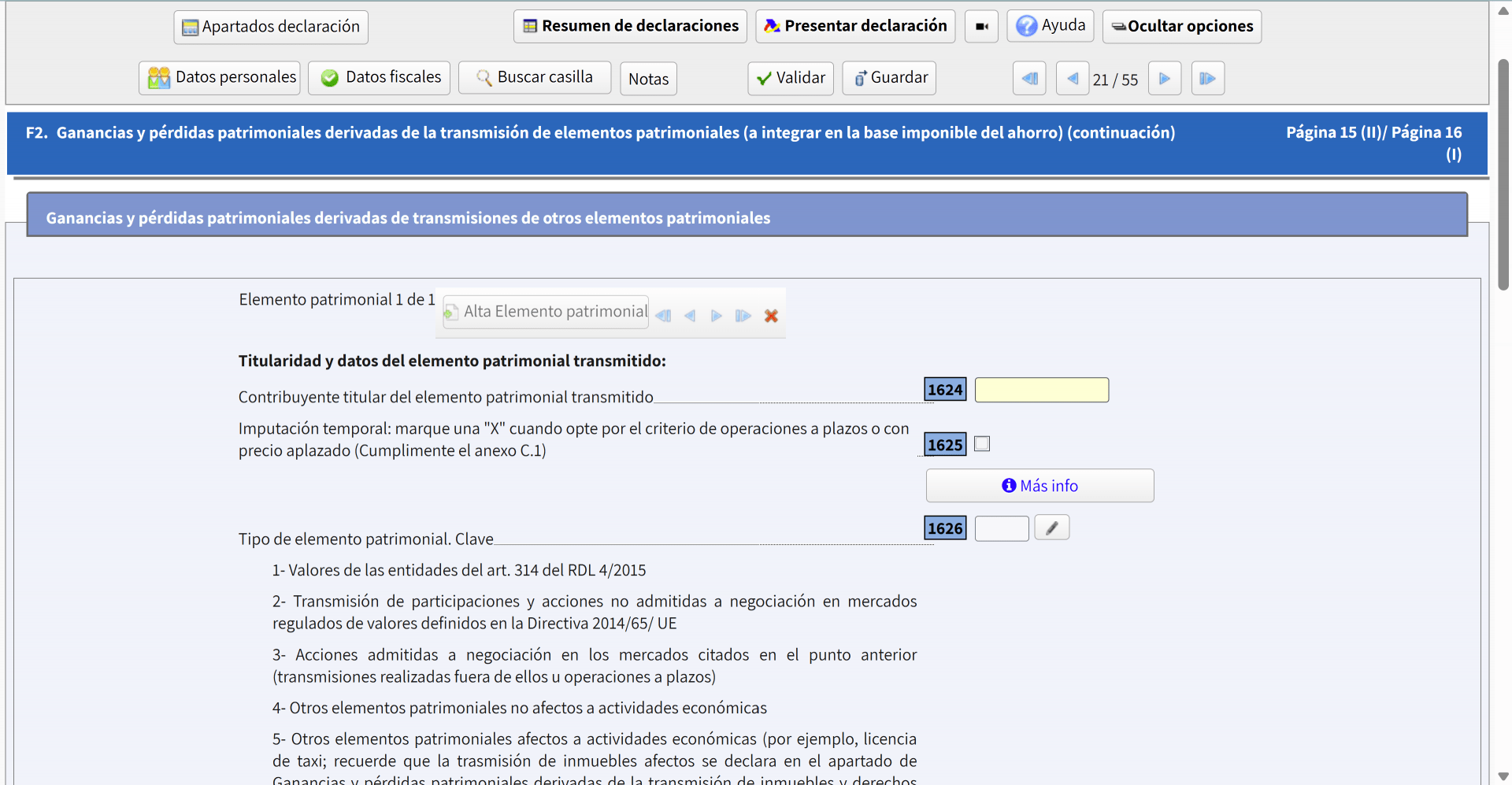

First, go to page 15(II)/page 16(I) of model 100, as shown in RENTA WEB – “F2. Capital gains and losses from the transfer of assets (to be included in the savings tax base) (continued),” specifically in the section "Capital gains and losses from transfers of other assets".

Once there, click on box 1626 “Type of asset”.

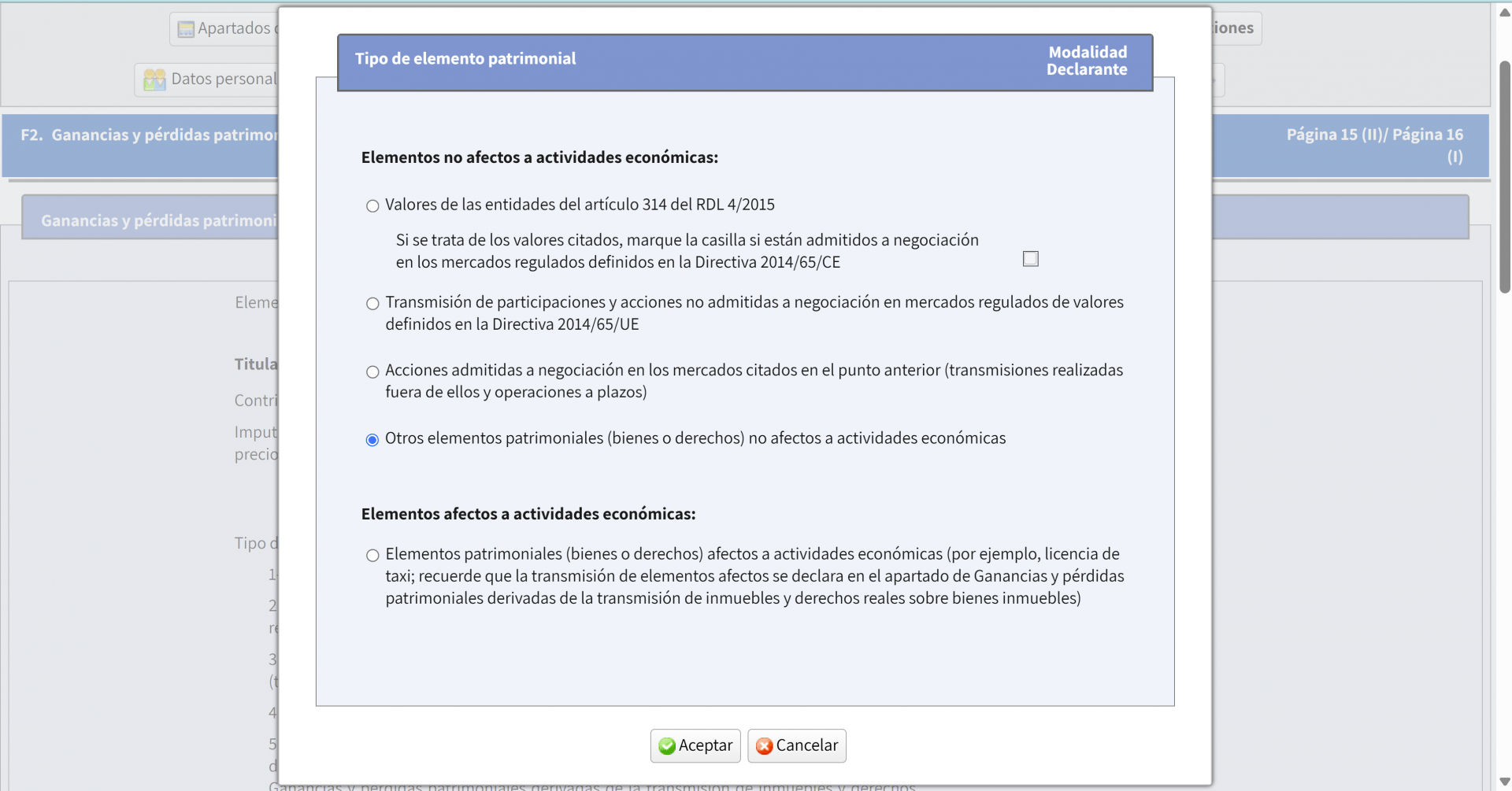

Next, select the fourth option: “Other assets (goods or rights) not related to economic activities".

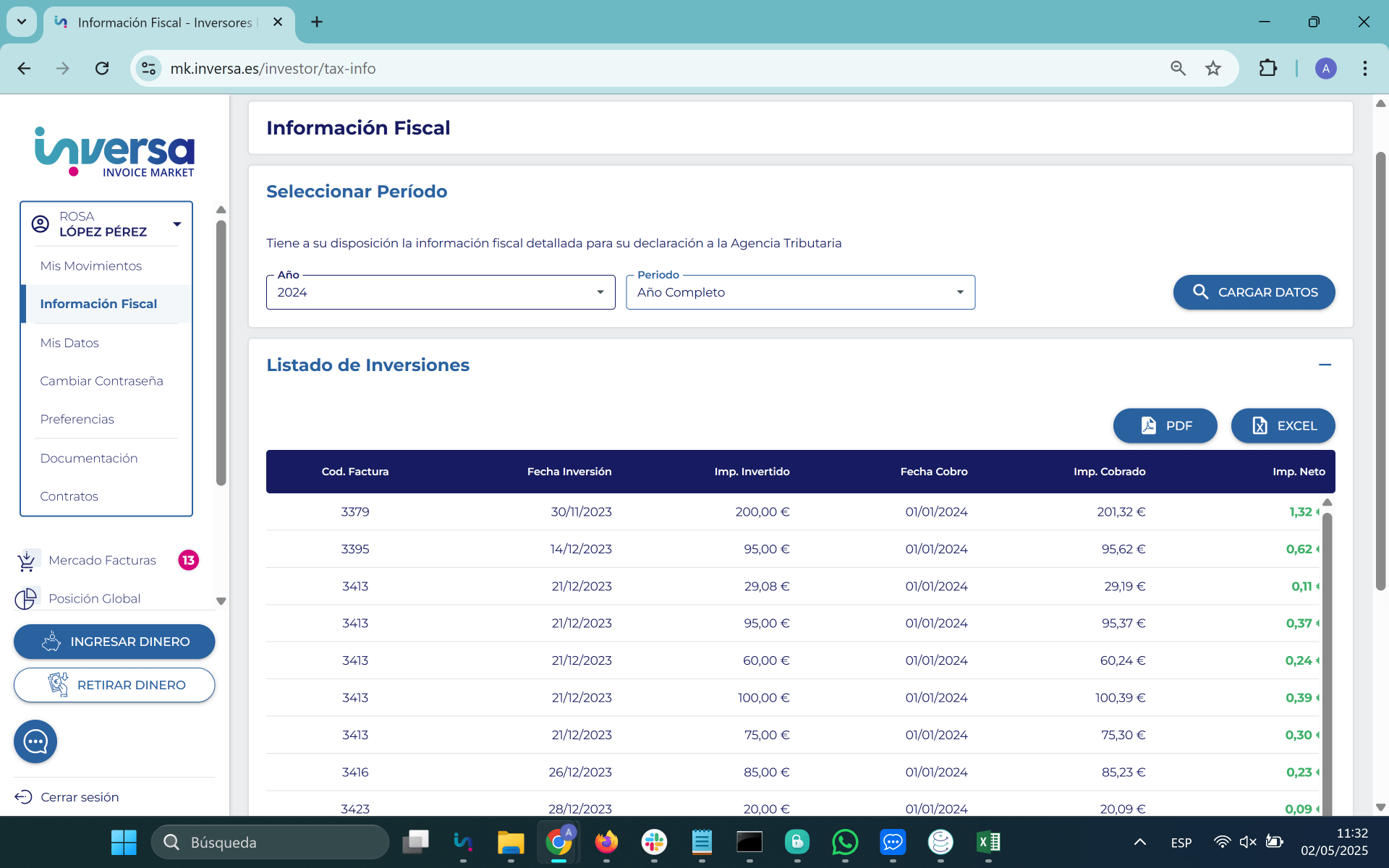

Now, we only need to enter the specific data of the transactions made. From the investor account, you can download the tax information for the full year, both in PDF and Excel formats.

For simplicity, our tax summary includes aggregated values to avoid listing all transactions.

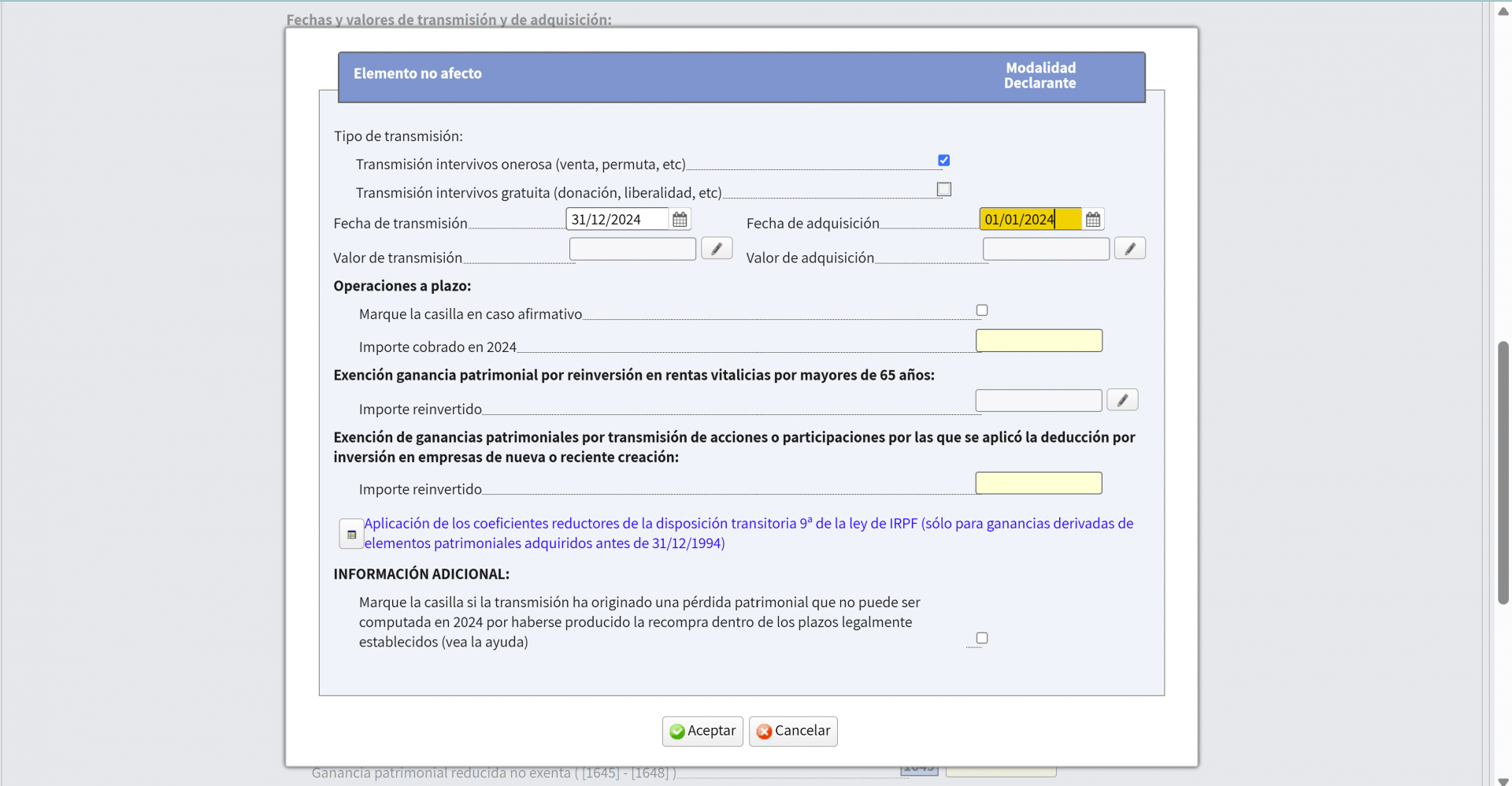

Accordingly, the following values should be entered:

- Transfer date: 31/12/2024

- Transfer value: Total amount listed as “Amount collected” in our tax report

- Acquisition date: 01/01/2024

- Acquisition value: Total amount listed as “Invested amount” in our tax report

This way, the net capital gains amount for the year should match exactly what is shown in our tax report.

* Note: INVERSA Invoice Market does not provide tax advice. This is an informative, non-binding article, and in case of doubt, potential investors are advised to consult an independent advisor.

Si quieres contribuir en el blog de Inversa como experto hazte socio del conocimiento.